Cocoa traders fall short on supplier disclosure in Ghana

Companies exporting cocoa from Ghana are failing to publicly demonstrate that their supplies are not grown on deforested land, according to research by Trase, raising questions over their sustainability commitments and their preparedness to comply with the EU deforestation regulation.

Ghana produces around 20% of the world’s cocoa, making it the second largest producer after Côte d'Ivoire. Cocoa production and export is a critically important activity for Ghana’s economy. Some 800,000 smallholder farmers in Ghana grow cocoa and rely on the trade for their livelihoods.

Yet cocoa production is also a major driver of deforestation. Ghana loses an average 42,000 hectares of native forest per year to the expansion of cocoa plantations. Deforestation results in biodiversity loss and contributes to climate change.

About 43% of Ghana’s cocoa is exported to the EU, where it is mostly used to make chocolate. Concern among consumers that the chocolate they buy is driving deforestation has contributed to the cocoa sector developing sustainability initiatives aimed at providing reassurance that the cocoa is deforestation-free.

The EU’s new deforestation regulation will greatly up the ante. From the end of 2024, it requires companies importing and exporting a range of agricultural commodities from the bloc, including cocoa, to prove that they were not grown on land deforested after 2020. Deforestation is moving from a reputational risk to a regulatory risk. Failure to comply means that cocoa producers and traders will lose access to the EU market.

New research by Trase shows that cocoa traders in Ghana may struggle to comply with these requirements because – despite their sustainability initiatives – they do not appear to know where most of the cocoa they trade is grown. Our analysis of voluntary corporate disclosures by cocoa traders in Ghana shows that while 80% of cocoa exports can be linked to a company that publicly discloses some supply chain information, there is only sufficient data to link it back to the district where it was produced for a mere 9% of exports.

The research used publicly disclosed data from the Cocoa Forest Initiative (CFI) whose membership includes 36 leading cocoa and chocolate companies operating in Ghana and Côte d'Ivoire and who are committed to mapping their supply chains and eliminating deforestation, as well as data published by companies themselves. The CFI reports that its members operating in Ghana were able to trace cocoa beans sourced from 361,395 mapped farms in 2021. Trase equates this to a maximum of 220,000 tonnes of cocoa beans, representing 21% of Ghana’s cocoa production and 57% of EU imports from Ghana in that year.

Lack of transparency

The poor quality of the data disclosed by companies makes it impossible to judge the veracity of company claims regarding deforestation-free supply. This is due to a few factors. There could be significant double counting of farms mapped by several companies. The locations of suppliers are not publicly reported, falling short of industry best-practice. Instead, traders simply disclose the names of supplier companies (known as licensed buying companies) or farmer groups, without reporting where the supplier companies source beans from, or where farmer groups are located. In other cases, the location information given lacks clarity or contains errors. Of the cocoa traders in Ghana, Trase found that only Barry Callebaut, Cargill, Ecom and Olam made disclosures that allowed the district of cocoa production to be identified.

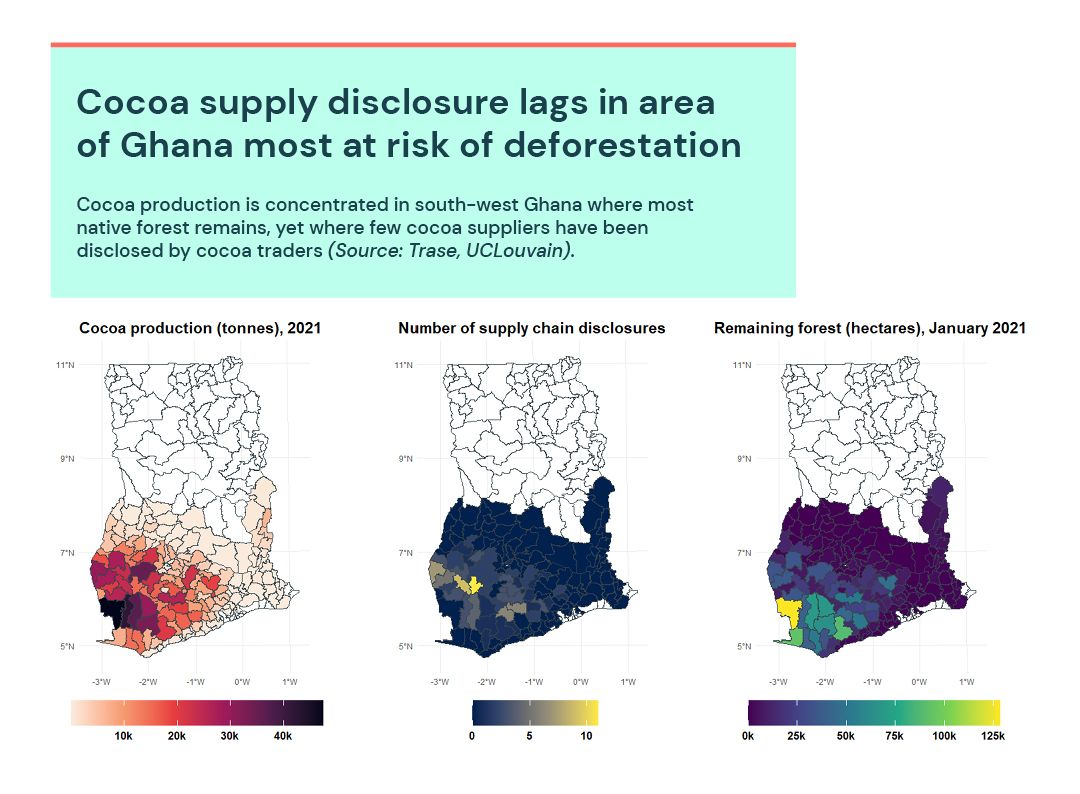

Trase mapped the locations in Ghana that these four companies call ‘direct sourcing’. It shows that a large area accounting for an estimated 19% of national cocoa production is omitted from public disclosures. This area hosts 29% (460,211 hectares) of the remaining forest in Ghana that is suitable to grow cocoa. Of most concern is the lack of disclosure in south-west Ghana where there is substantial cocoa production adjacent to significant areas of forest (see map).

Of the four trading companies that made disclosures allowing the production district to be identified, only Barry Callebaut and Cargill disclose both the location and the size (number of farmers) of their collection points. This lack of transparency hinders efforts to map the cocoa supply chain at subnational resolution, as Trase does in neighbouring Côte d’Ivoire. Trase estimates that Barry Callebaut has mapped 48% of the 121,000 tonnes it sources from Ghana, while Cargill has mapped 16% of its 125,000 tonne supply.

Improvements urgently needed

Ghana’s cocoa board, Cocobod, which regulates the country’s cocoa trade, is developing a cocoa traceability system in part to enable compliance with the EU deforestation regulation. At a meeting in June, Cocobod urged stakeholders to support the system, which should enable cocoa to be traced from the shipping port to the plot of land where it was grown.

A key concern for both the future national traceability system and current company traceability efforts is the lack of transparency. Trase recommends that cocoa traders and Cocobod follow the Accountability Framework – a practical roadmap for reporting, disclosure and claims in the agriculture and forestry sectors supported by a range of civil society groups, companies and financial institutions. Specifically, we recommend the disclosure of the location and volume of the direct suppliers on an annual basis.

Trase’s research only assessed what companies call direct supplies of cocoa in Ghana. It is unclear how much cocoa is sourced ‘indirectly’, via additional intermediaries, with even less visibility back to origin. Trase recommends that companies, in particular members of the CFI, disclose the overall proportion of their cocoa that comes from indirect sources, and also the location and volumes purchased from each immediate supplier.

The authors thank Adeline Dontenville, Michaela Foster, Jackson Harris, Patrick Meyfroidt and Cécile Renier for their expert contributions to this article.

Article citation: Richens, J. A. E., Guye, V., & zu Ermgassen, E. (2023). Cocoa traders fall short on supplier disclosure in Ghana. Trase. https://doi.org/10.48650/HY9G-N485

References

Kalischek N, Lang N, Renier C, et al, 2023. Cocoa plantations are associated with deforestation in Côte d’Ivoire and Ghana.

Renier C, Vandromme M, Meyfroidt P, Ribeiro V, Kalischek N, Ermgassen EKHJZ, 2023. Transparency, traceability and deforestation in the Ivorian cocoa supply chain.

Vancutsem C, Achard F, Pekel JF, et al, 2021. Long-term (1990–2019) monitoring of forest cover changes in the humid tropics.