How to ensure due diligence policies actually tackle deforestation

Human rights and environmental due diligence can clean-up specific commodity supply chains, but to ensure that products linked to deforestation are not redirected elsewhere, governments need to build synergies with other policies for sustainable land use.

Mandatory human rights and environmental due diligence has emerged as a new standard for companies and countries purchasing forest-risk commodities such as soy, cocoa or palm oil. The European Union (EU) has led such efforts, approving a deforestation regulation (EUDR) which requires businesses to prove that agricultural commodities do not come from recently deforested land. Moreover, the proposed corporate sustainability due diligence directive (CSDDD) aims to require companies to identify and address environmental and social impacts in their supply chains.

These policies are expected to reduce the EU’s role in contributing to tropical deforestation. However, to help ensure that this translates into actual reductions in deforestation on the ground, additional measures are needed. For while commodities linked to deforestation may be removed from the EU’s supply chain, it is of little benefit if they are sent to countries without these environmental regulations or consumed domestically.

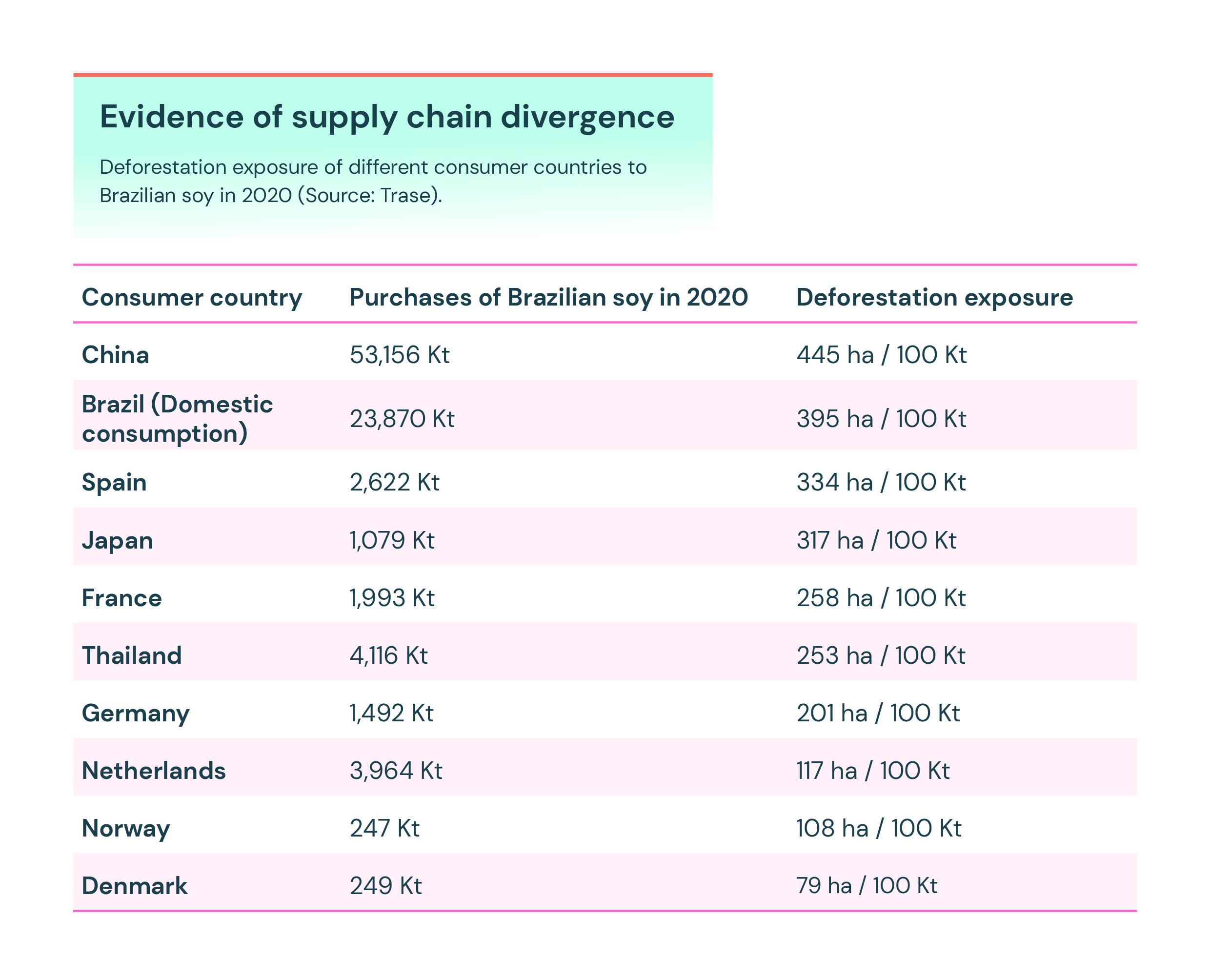

New research using Trase data shows that supply chain divergence to meet different consumer requirements already is a reality. Brazil’s exporters, for example, sell soy to Denmark and Norway that is four-times less exposed to deforestation than soy sent to China or used domestically (see table).

The researchers interviewed companies from the Brazilian soy sector and confirmed such segmentation is both predictable and standard practice. While physical segregation of soy grains can be challenging, it has not been difficult for certain traders and regions exposed to very different levels of deforestation to specialise in markets that demand higher or lower levels of sustainability.

The most notable case is that of ALZ Grãos, a joint venture created by Amaggi, Louis Dreyfus Company, and the Japanese firm Zen-Noh to operate exclusively in the Matopiba region, one of Brazil’s leading deforestation frontiers. The parent companies focus on exporting soy from well-established agricultural areas with much lower deforestation, including to the more demanding Nordic markets. Meanwhile, ALZ, which exports soy exclusively to Asia, is exposed to as much as 20-times more deforestation per tonne of soy.

Beyond cleaning individual supply chains: Making due diligence policies work

It is clear that environmental due diligence would fall short of its potential to tackle agriculture-driven deforestation if producers responded by channelling ‘clean’ supplies to Europe while carrying on with business as usual for consumption elsewhere. The EU would risk merely becoming a niche market, while tropical forest loss for the most part would continue unabated.

Instead, the EU is hoping that its higher environmental and human rights standards for agricultural commodity trade will trigger a so-called ‘Brussels effect’, where such standards would become the new global norm. Such a convergence to the top can have two general routes. First, companies may choose to streamline their global activities according to those standards, making them the new benchmark across the sector (de facto Brussels effect), as has happened in some other policy areas such as data privacy, consumer safety and, more recently, artificial intelligence. Second, other consumer countries may follow suit and emulate European policy-making on mandatory human rights and environmental due diligence (de jure Brussels effect).

The EU has historically had a powerful influence in setting global regulatory standards thanks to its institutional capacity to design and implement complex regulatory measures, and the attractiveness of its affluent market, which companies are not usually inclined to forgo. However, a declining market share is a key factor limiting the EU’s influence. Cocoa and coffee producers, for whom the EU is a major consumer, are more likely to embrace the EU’s higher standards. But for other crucial forest-risk commodities such as soy, beef and palm oil, the EU commands only a small and diminishing share and therefore has much less ability to catalyse change in the global market.

The researchers propose three ways for the EU to enhance its due diligence policies to have an outsized effect beyond cleaning up its own supply chains.

1. Get other major consumer markets on board, notably in Asia

Asian countries import increasing amounts of forest-risk agricultural commodities. China accounted for 75% of Brazil’s soy exports in 2023. In contrast, the EU imported just 10%. India is the largest buyer of Indonesian palm oil, and together with China, they took approximately 40% of the palm oil that the Southeast Asian country exported in 2022/2023, compared to only 12% sent to the EU. Other countries in the region, such as Japan and Thailand, also import more soy from Brazil than most European countries.

Through diplomacy and engagement with governments in these markets, the EU could share experience with the EUDR and its mechanisms such as risk benchmarking, traceability and monitoring to lower entry costs and help persuade them to embrace a similar approach. That could create a critical mass for higher environmental and human rights standards which then become a new global baseline.

2. Require due diligence from companies irrespective of where they do business and include the financial sector

The EU may have become a relatively minor buyer of some forest-risk commodities such as beef and soy, yet its economic influence in such supply chains far exceeds that of an importer. Large companies trading in commodities between countries such as Brazil and China often have headquarters and operations in the EU, meaning they are subject to EU regulations. Moreover, EU financial institutions provide investments and loans to agricultural commodity traders, and therefore could have significant influence over their management of environmental, social and governance (ESG) issues, irrespective of where their commodities are actually consumed.

French and German laws already contain elements of what could be scaled up in the CSDDD, including requirements that any company headquartered or having more than a certain number of employees in those countries must report on the ESG performance of their activities abroad as well as on those of their suppliers and subsidiaries. Such rules can be much more powerful if applied at the EU level, and even more so if they also include the financial sector.

On 15 March, the EU Council finally agreed on the scope of the CSDDD after late challenges by some countries put its future in doubt. If the directive is eventually approved, it would be important to see whether its ambition measures up to the challenge.

3. Combine ‘do no harm’ due diligence measures with ‘do good’ policies to address agriculture-driven deforestation at the landscape level

Mandatory human rights and environmental due diligence essentially seek to avoid causing harm to people or the environment in countries of production. However, the EU and other advanced economies also have at their disposal numerous policy instruments such as agricultural cooperation, development aid and incentives for the promotion of sustainable value chains – including those around the bioeconomy or novel products that spur local economic development while keeping forests standing.

At the landscape level, the EU and other players could engage more strategically to support activities such as sustainable land uses by smallholders, SMEs and indigenous peoples that can hedge against deforestation, but which often fail due to lack of economic or technical support. By combining such ‘do good’ policies with human rights and environmental due diligence, demand-side actors could actually foster landscape-level transformations that use their role as importers as a foothold, while creating an outsized impact.

This requires thinking beyond the due diligence toolbox to combine it strategically with other policies. Such actions need to involve meaningful partnerships with producer countries that co-create enabling conditions for compliance and are long-term and of sufficient scale. Partnership measures need to zoom out from individual forest-risk supply chains to address the needs of other actors and the strategic roles they could play in fostering a transition to zero deforestation and conversion in landscapes of concern. Such measures can not only increase the effectiveness of the EUDR in actually reducing deforestation but also help mitigate and avoid the growing resistance to foreign demand-side policies in producer countries. Perhaps most importantly, such measures would catalyse political support for much-needed sustainable development alternatives in deforestation frontiers.

Bastos Lima, M.G. & Schilling-Vacaflor, A. (2024) Supply chain divergence challenges a ‘Brussels effect’ from Europe's human rights and environmental due diligence laws. Global Policy, 00, 1–16. Available from: https://doi.org/10.1111/1758-5899.13326