Trase links Belgium’s commodity imports to water scarcity

Unsustainable demands for water threaten global food security and have serious environmental impacts. A new report from Trase explores how Belgium’s imports of agricultural commodities are connected to water scarcity around the world.

More than three-quarters of the planet’s freshwater resources are devoted to crop or livestock production, while three billion people live in areas where agriculture is affected by water shortages. As global consumption continues to rise, demand for water could outstrip supply by 40% as soon as 2030. Increasing abstraction of water to irrigate crops has serious ecological impacts, driving precipitous declines in freshwater biodiversity.

To build resilient supply chains and minimise environmental impacts, governments must urgently understand the complex trade linkages that connect them to crop production and water use around the world.

Trase was commissioned by Belgium’s Federal Public Service for Heath, Food Chain Safety and Environment to explore the country’s dependencies on global water resources and potential impacts in water-scarce regions. In this study, we estimated the water requirements of Belgium’s demand for dozens of agricultural commodities.

To do so, we considered trade from three different but complementary points of view: direct trade from producer countries to Belgium; trade after adjusting for the re-exports of commodities via other countries; and an approach using modelling to estimate the water demands of commodities used in products that Belgium consumes (read our explainer to understand more about these three complementary perspectives).

We also considered three different water consumption metrics to capture Belgium’s water demands as comprehensively as possible.

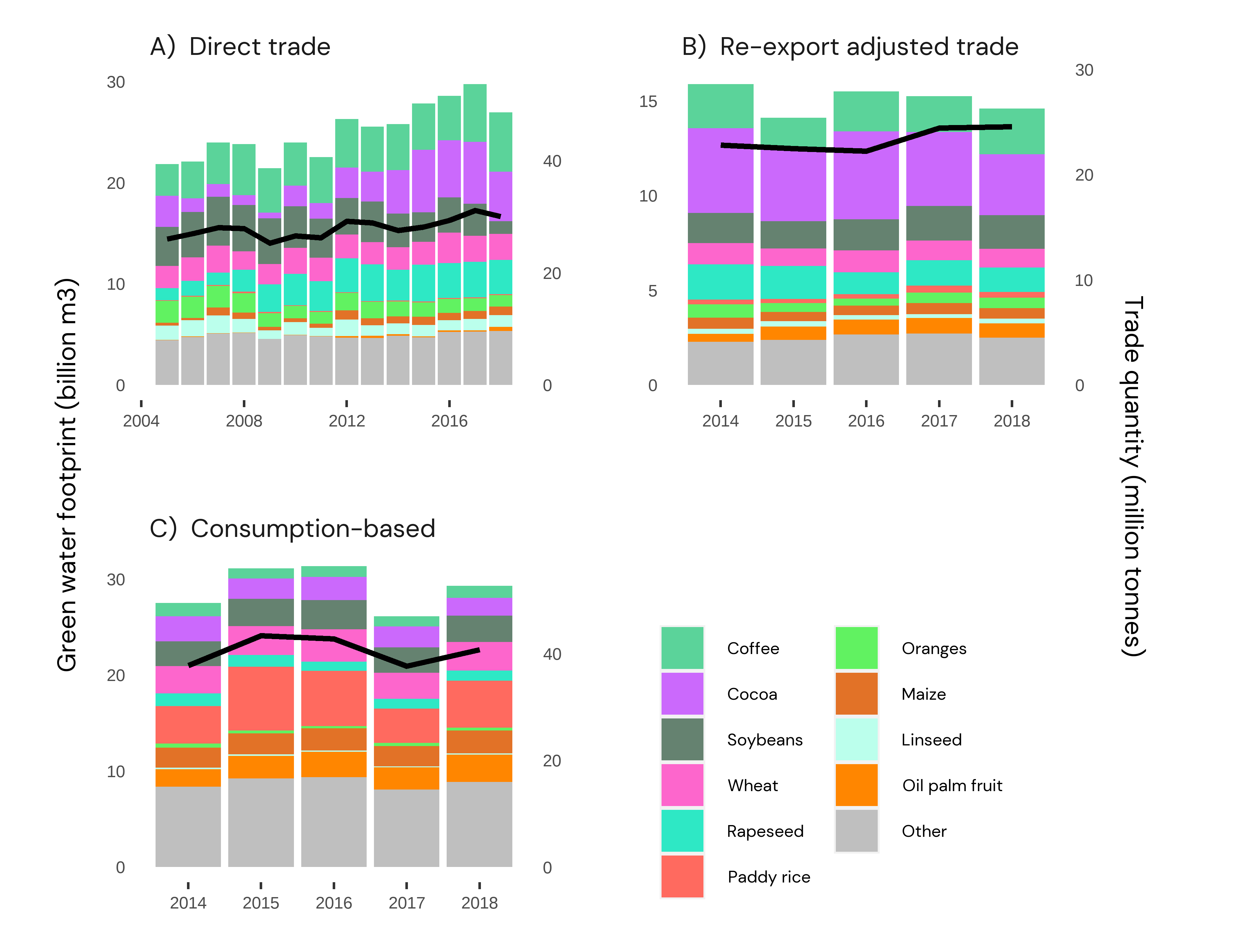

Water requirements met by rainfall

First, we considered Belgium’s ‘green water’ requirements: the water directly available from rainfall and soil. Belgium is a major importer and processor of cocoa and coffee, and this was clearly reflected in its green water footprint, as these two commodities make up 40% of Belgium’s footprint from the direct trade perspective. Other important commodities were soybeans, wheat and rapeseed (Figure 1). Côte d’Ivoire is the most important country (15% of Belgium's direct trade footprint) thanks to its role as the world’s largest cocoa producer.

The consumption-based approach shows that other commodities are important too, such as oil palm and rice, suggesting that Belgium is driving demand for water via these commodities in processed products and other indirect ways that are captured by this perspective.

Figure 1: The most significant commodities that make up Belgium’s green water footprint from three different trade perspectives: direct trade (A), re-export adjusted trade (B) and a consumption-based approach (C). Bars are coloured according to the water footprint of individual commodities. The black line and right-hand axis shows the overall trade volume of the included commodities.

Water requirements met by irrigation

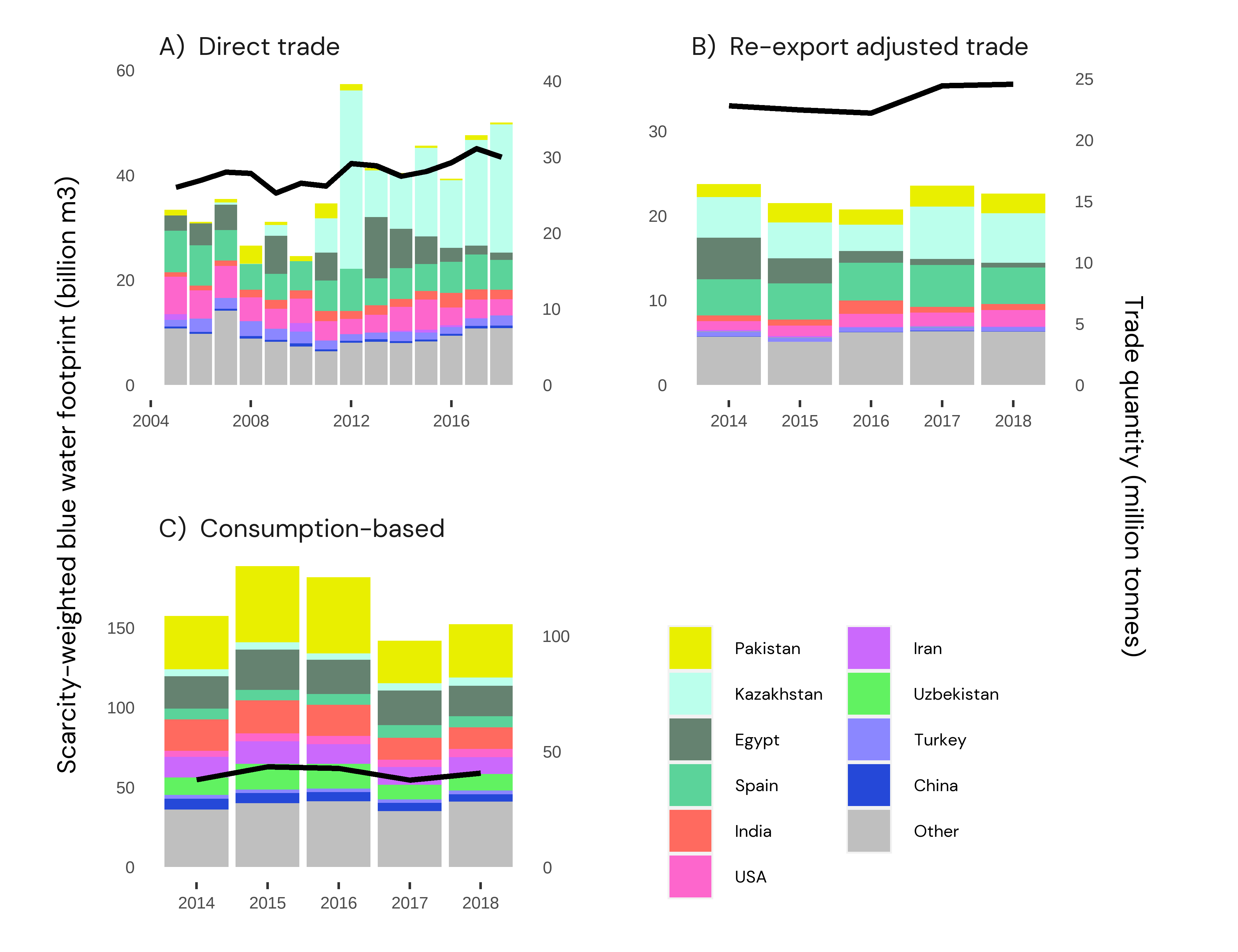

We next considered ‘blue water’: the water requirements met by irrigation, such as water taken from rivers, lakes and groundwater supplies. This produced a very different footprint, with a strikingly large (and rising) demand for irrigated water from linseed (of which Belgium is the world’s largest importer), most of which was produced in Kazakhstan. Linseed (also known as flax) has become popular in bakery and health food products due to its omega-3 and fibre content. It is also crushed to make oil for paints while the meal is used for animal feed. From a consumption-based perspective, commodities like cotton, rice and wheat were also very important.

This blue water metric estimates the water irrigation requirements of Belgium’s imports, but not the impacts. Weighting the blue water footprint according to water scarcity (our third water metric) helps us understand this. Doing so emphasised the importance of commodities such as olives, linseed and cotton, and also draws attention to countries like Spain, Kazakhstan, Pakistan and Egypt that produce them (Figure 2).

Figure 2: The most significant producer countries that make up Belgium’s scarcity-weighted blue water footprint from three different trade perspectives: direct trade (A), re-export adjusted trade (B) and a consumption-based approach (C). Bars are coloured according to the water footprint of individual countries. The black line and right-hand axis shows the overall trade volume of the included commodities.

Empowering consumer countries to take action

Should Belgium respond to this analysis by switching imports of water-intensive commodities away from water-scarce regions such as linseed from Kazakhstan?

In practice, this is unlikely to be a feasible, or even desirable, solution as particular countries often have specialised expertise, production systems and environmental suitability to produce certain crops, limiting the potential to change sourcing patterns. Moreover, commodities produced in environmentally damaging ways could simply be sourced by other, perhaps less discerning, consumer markets.

Instead, Belgium could use its unique trade relationships, such as its role as the global hub for the linseed trade, to engage with governments and commodity producers and encourage more sustainable water use in countries like Kazakhstan.

Governments have a variety of tools at their disposal to do this: for example, they could incorporate water conservation standards into trade agreements, or draw attention to wasteful subsidies that currently incentivise excessive water consumption. Multilateral fora can be a means to support effective water governance and improve access to finance and technology for farmers at the front lines of water conservation in developing countries. Trase’s study highlights the commodities and countries where Belgium may have the most leverage and impact.

Tackling multiple environmental challenges

Water scarcity is just one of many environmental challenges facing the global food system. Trase has also explored how Belgium’s commodity imports expose it to deforestation and biodiversity loss. This highlights particular countries and commodities where multiple sustainability challenges could be tackled at once, avoiding the pitfall of a narrow focus on deforestation while overlooking other important issues.

For example, Belgium’s direct imports of soybeans and tobacco ranked highly for impacts including deforestation, biodiversity loss and water scarcity. Trase flags coffee and cocoa as priorities for action by Belgium to tackle its impact on both biodiversity and deforestation, while maize and linseed are both important for Belgium to reduce its biodiversity and water footprints.

Through Trase’s work for Belgium’s Federal Public Service, we have provided a comprehensive assessment of how deforestation, biodiversity and water-related environmental risks can be embedded in national consumption and trade activities. As we highlighted in a recent briefing for the T20, an advisory group of the G20 summit in India, taking action on these ‘offshored’ environmental impacts is critical to meeting international sustainability targets and mitigating environmental risks.

Read the full report: Titley, M., Croft, S., Egan, C., & West, C. (2023). Assessing the water footprint of Belgium’s agricultural commodity supply chains. Trase. https://doi.org/10.48650/QE4S-AN74