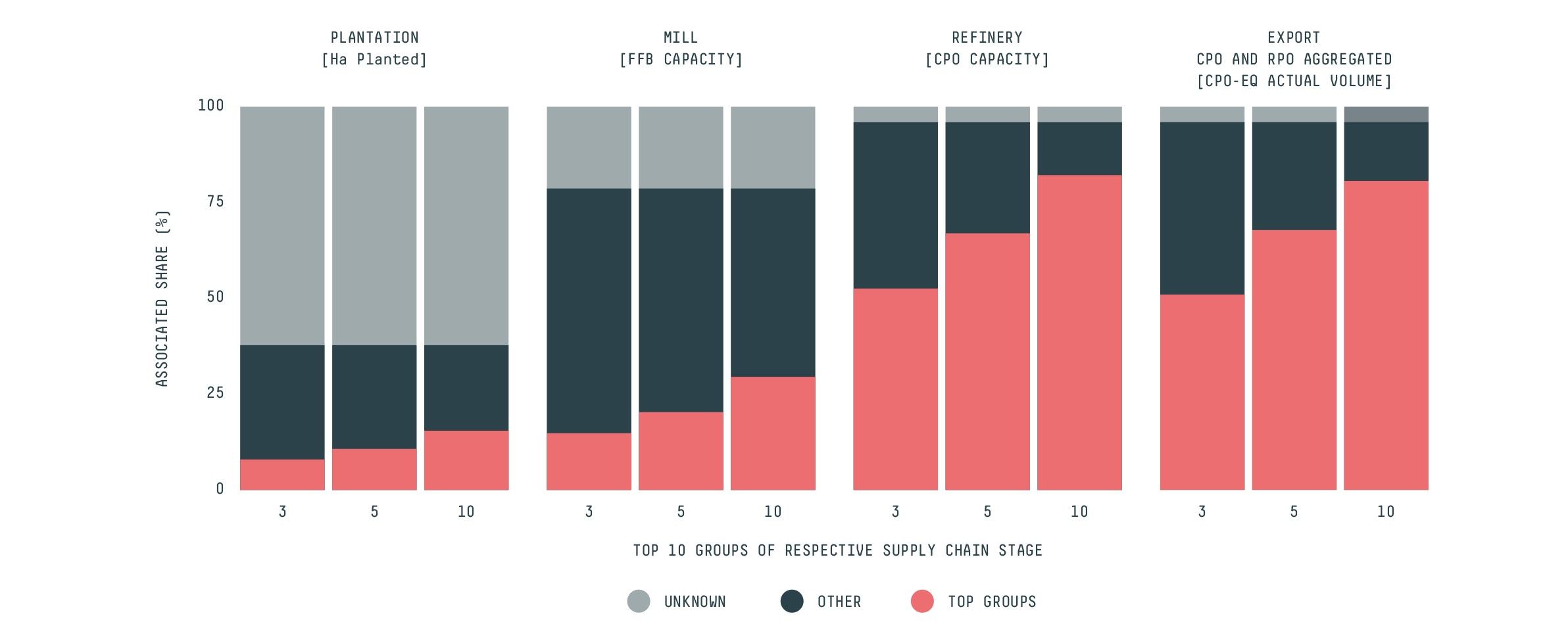

In a recent analysis, Trase classified hundreds of companies involved in the export of Indonesian palm oil according to their corporate ownership structures. This analysis revealed a high level of dominance, with the five largest corporate groups controlling about two thirds of total refining capacity and export volume across the country. In contrast, hundreds of smaller corporate groups and individual companies own mills and plantations, while hundreds of thousands of independent smallholders are involved in production.

This very high level of dominance among traders – fairly common in global commodity markets – means that sustainability commitments made by a small number of corporate groups at the refinery or trader level potentially cover a much larger group of upstream suppliers. In the case of Indonesian palm oil, 81% of oil palm exports in 2018 were covered by some level of zero-deforestation commitment – a level of coverage that is far greater than that in most other commodities, including Latin American soy and beef.

However, the diversity of sourcing relationships between exporters and refineries and mills and between mills and plantations and smallholders, coupled with gaps in the availability and quality of data on production, plantation ownership and smallholders, make it difficult to map palm oil flows back to production landscapes. The top five exporting company groups have all released traceability reports that list which mills have supplied their refineries – this is an important step to greater transparency but needs to include information on volumes.

These data gaps severely limit the ability of downstream actors like exporters to influence or monitor compliance with social and environmental sustainability standards among producers, and therefore to report accurately on progress towards no deforestation, no peat, no exploitation commitments.