Moving beyond commitments : How to start eliminating deforestation from investor portfolios

Investors need to understand deforestation-risk exposure in their portfolios to inform effective engagement activities and deliver on COP26 pledges.

The COP26 climate talks started with more than 100 governments representing over 85% of the world’s forests committing to halt and reverse deforestation by 2030. The declaration was backed up with $12bn of public funds to protect and restore forests alongside $7.2bn of private investment.

Over 30 financial institutions joined the UN’s Race to Zero campaign by committing to use their best efforts to eliminate agricultural commodity-driven deforestation from portfolios by 2025. There were also commitments from 10 global commodity traders to halt deforestation.

While the combined $8.7 trillion in assets of the 30 financial institutions that signed the Race to Zero commitment is significant, key absent signatories included many of the top 20 Brazilian beef, soy and Indonesian palm oil investors most exposed to deforestation risk.

Many of the largest passive investors most exposed to deforestation risk via the companies in the indices tracked by their index funds, such as Blackrock, Vanguard and State Street, were also absent. Indeed the combined assets of these managers alone is approximately $20 trillion. Difficulties in changing long-held index methodologies aside, there was no reason why passive investors could not sign the commitment and reverse a trend of abstentions and blocking deforestation votes at shareholder meetings.

The commitments from financial institutions are welcome, but observers all too familiar with the “blah, blah, blah” (as climate activist Greta Thunberg put it) of headline-grabbing commitments are asking questions such as:

- What do “best efforts” mean in practice for investor engagement with portfolio companies?

- Do these institutions fully understand the direct and indirect deforestation risk exposures they currently face?

- What tools and data will they use to tackle these risks beyond the woeful mainstream ESG scores currently available?

- Given that 2025 is just around the corner, what time horizons are investors working towards to see real progress in eliminating deforestation before they consider excluding certain securities or ‘the Big D’ – Divestment?

The Finance Sector Roadmap for Eliminating Commodity-Driven Deforestation, developed by the Finance & Deforestation Advisory Group (of which Trase Finance partner Global Canopy is a member) and launched at COP26, answers many of these questions by defining best practice for financial institutions to implement a 2025 commitment, providing intermediate steps, guidance and points to data and tools to meet those steps.

Measuring deforestation-risk exposure

So how should investors measure their exposure to deforestation? There are now a number of tools and datasets available to investors highlighted in the roadmap – including the equity risk allocation methodology of Trase Finance.

Trase Finance uses supply chain modelling to allocate annual commodity-specific deforestation risk in hectares to investors based on their total equity ownership in commodity traders exposed to deforestation via investing subsidiaries and fund shareholdings. For the first time this allows for a quantifiable and robust way to rank asset managers according to their exposure to deforestation risk.

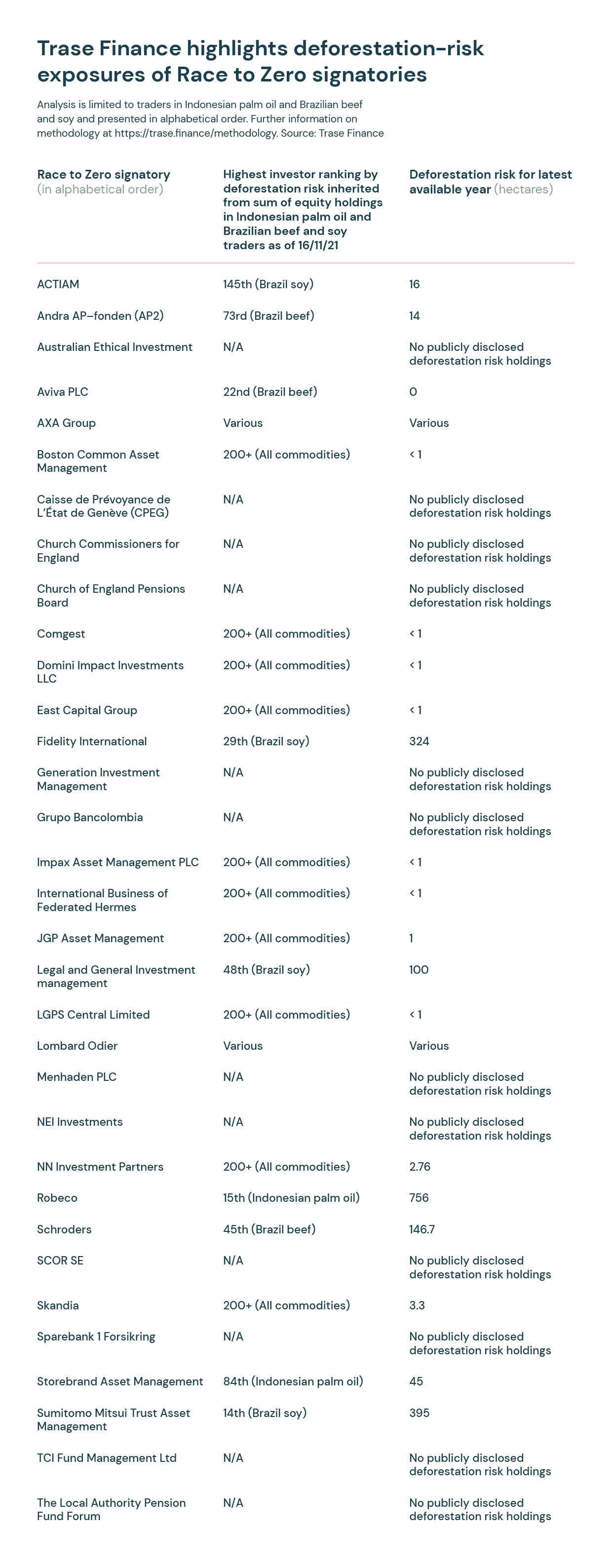

Reviewing the exposures of the signatories shows interesting results (see table). For most, deforestation-risk exposure from Brazilian soy and beef and Indonesian palm oil is relatively small – often less than one hectare given that most mutual fund managers own large numbers of small minority shareholdings in portfolio companies.

However, for a number of signatories the equity exposures are considerably larger, going into hundreds of hectares of deforestation risk per year. Critically, Trase Finance data is very conservative in its estimates as it focuses on traders of three key commodities accounting for 60% of global commodity trade, meaning many investor groups are likely to face larger exposures when holdings in other supply chain companies and commodities are considered.

For example, Robeco is exposed to 756 ha of deforestation risk, almost half of which is attributable to a single portfolio company, Marfrig Global Foods. This exposure comes from eight Robeco funds which account for 299 ha of deforestation risk via a 2.3% equity share of Marfrig’s 12,801 ha of annual beef deforestation (as of 21 November 2021).

Clearly there is still much to do before 2025 to achieve deforestation-free portfolios, but starting with understanding current quantitative deforestation risk exposures is essential.

Active engagement to drive change

Where should financial institutions start with managing their deforestation risk? Engaging with portfolio companies to strengthen their policies and actions on deforestation to deliver changes on the ground would be a good place to start. Investors could table deforestation elimination votes with portfolio companies such as that brought by Storebrand and Green Century Capital Management in 2020 at Bunge’s annual shareholder meeting using data from Trase Finance and Forest 500. Green Century outlined a number of practical steps many of the signatories could replicate with other portfolio companies:

- Commitment to eliminate the conversion of all native vegetation in soy supply chains;

- Cut-off dates in supply chains that perpetuate native vegetation conversion;

- Participation in industry sourcing agreements seeking to curtail native vegetation conversion in the Cerrado;

- Improved supplier management efforts, including engagement on supplier non-compliance, disclosing suspension criteria, and increased use of third-party monitoring and verification.

Time is of the essence

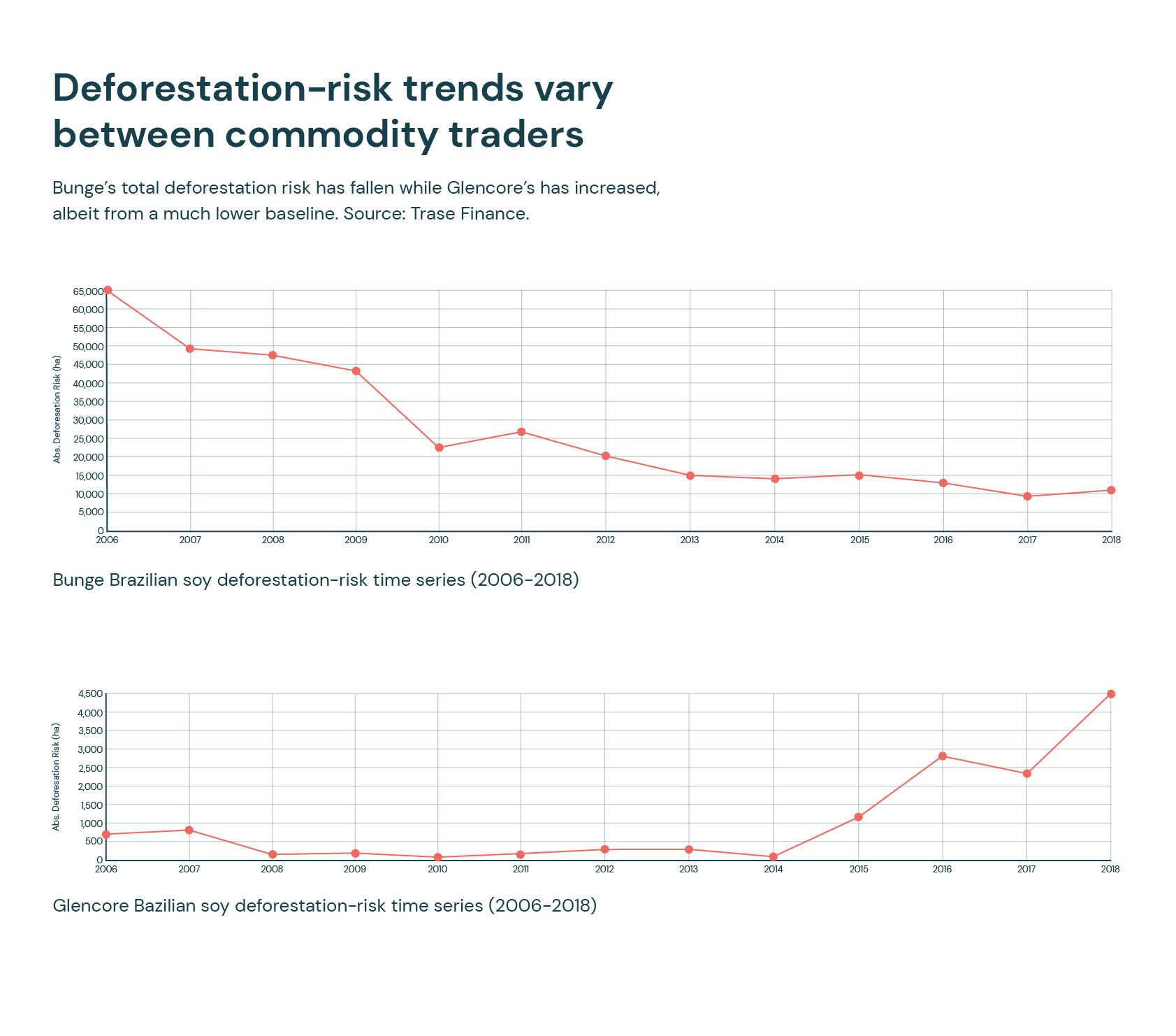

The time for progress is short with the 2025 deadline looming. While for some portfolio companies the year-on-year deforestation-risk trend is downward, Trase Finance shows that for others it is increasing (see graphs).

Bunge, held by at least 14 of the signatories, is an example where Brazilian soy deforestation risk has fallen from 66,000 ha in 2006 to 11,000 ha in 2018, albeit in the context of falling deforestation overall in the Cerrado where most of the deforestation linked to soy expansion occurs. In contrast, Glencore, held by at least 11 of the signatories, has become increasingly exposed to soy deforestation risk during the same period, and per tonne of soy traded has a higher risk exposure than Bunge, even if it is associated with less deforestation risk overall.

While Glencore spun off and rebranded its Glencore Agriculture arm to become Viterra, it retains a 49.99% stake in the venture. Thus signatories need to continue to engage with Glencore on soy deforestation given ongoing exposure, even if there is little mention of grain, food and soy as future strategic priorities for the business on the main Glencore website.

An important question is how long asset managers will give portfolio companies to eliminate deforestation risk before the 2025 deadline and whether failure to do so will trigger divestment.

Given the typical contract lengths for supply chain agreements and the long lifespan of newly constructed agricultural assets, it is clear that progress needs to be made immediately. As financing new oil and gas projects flies in the face of net-zero commitments, financing the development of commodity production assets in frontier regions should be considered inconsistent with zero-deforestation pledges.

Using financial leverage to make a difference

To help deliver this, signatories could agree not to increase equity positions in discretionary funds in traders whose deforestation-risk curves are not showing a clear downward trajectory compared to the baseline.

Similarly, investors could also agree a moratorium on subscribing to new issuances of corporate debt of those not able to demonstrate that they are decreasing their deforestation risk. Even though many of these issuances are for general purpose financing, inevitably some of these funds could be deployed to deforestation-risk infrastructure projects such as ports, grain elevators, storage facilities, crushing facilities and the like.

Ceasing to subscribe to debt issuances in particular could be a useful leverage point for signatories looking to incentivise portfolio companies to adopt deeper traceability requirements and other improvements. Medium-term notes, a common debt instrument issued by traders, will typically have a 5-10 year maturity, meaning institutional investors purchasing bonds today would typically be exposed to credit and ESG risks linked to use of proceeds until perhaps 2031 and beyond.

Trase Finance is the only platform available to investors to manage their portfolio deforestation risk using quantitative tools which calculate a total exposure in hectares of forest loss. Integrating a variety of geospatial, supply chain, ownership and financing data, the platform calculates and aggregates the risk of over 400,000 equity positions to assign a total deforestation risk to investors. Combined with policy frameworks and tools, this enables investors to adopt targeted engagements with exposed portfolio companies.

To reference this article, use the following citation: Phare, J. (2021). Moving beyond commitments : How to start eliminating deforestation from investor portfolios. Trase. https://doi.org/10.48650/BWAM-5E27