Beyond forests: traders face EU regulatory risks from soy expansion in Brazil

Soy traders are more exposed to the conversion of Brazil’s savannah and grassland habitats than they are to forests. As the EU considers including other ecosystems in its new due diligence legislation, Trase analysis reveals which traders face the biggest regulatory risks.

Read in other languages:

Português brasileiroUnder the incoming EU regulation on deforestation-free products, commodity traders will soon have to prove that products such as soybeans and palm oil destined for the EU market are not linked to the conversion of forests. In future, this may be broadened out to include other ecosystems.

This would have major implications for soy traders sourcing from Brazil: only 17% of recent soy expansion into natural habitats was into forested areas, with traders much more likely to be sourcing soy that has encroached on Brazil’s biodiverse Cerrado savannahs and Pampa grasslands.

In the first review of the regulation, due to take place no later than September 2024, the EU will consider including ‘other wooded lands’, which would increase coverage of the Cerrado from 26% to 82%. A year later, in September 2025, the inclusion of grasslands and wetlands will be considered.

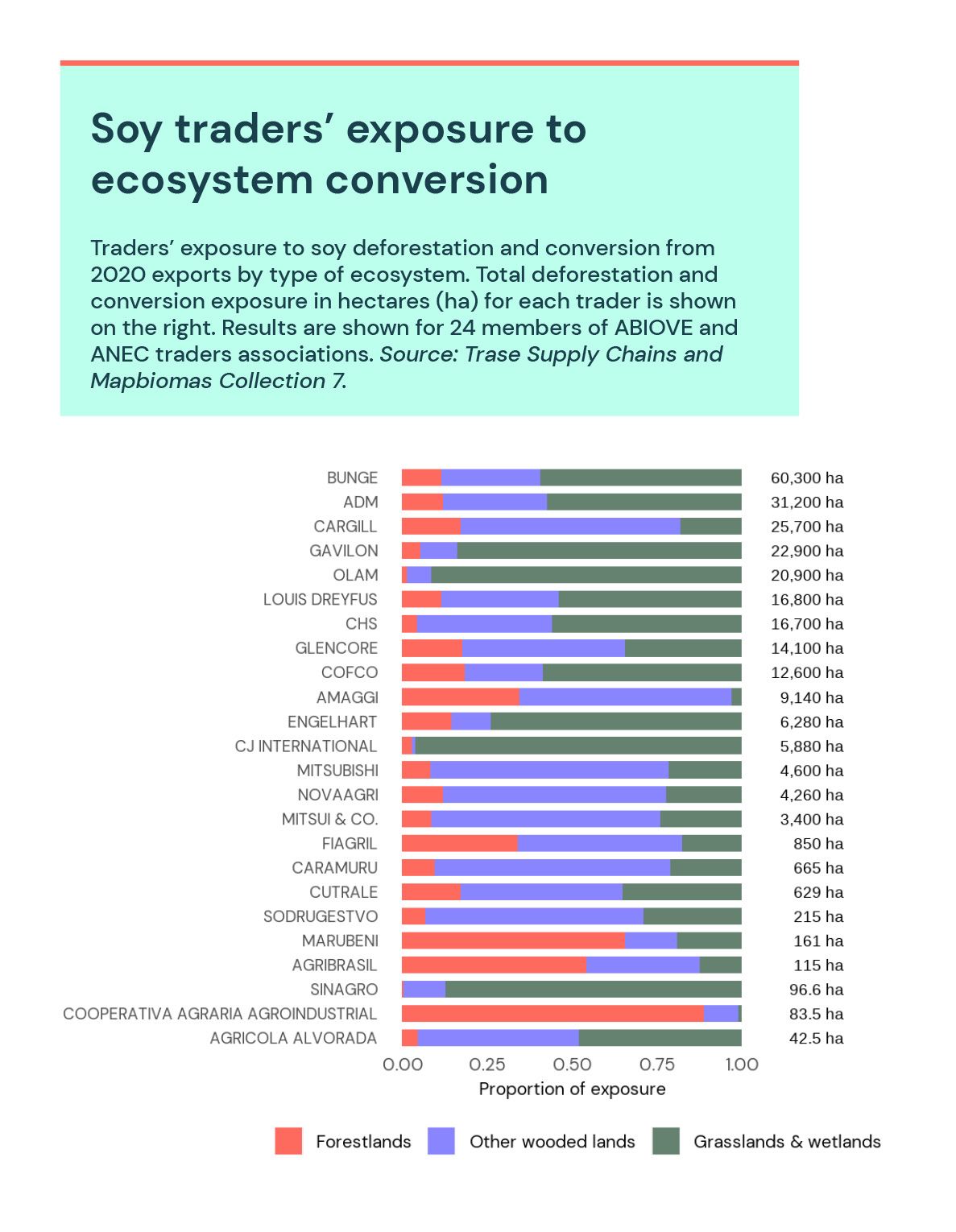

New Trase analysis reveals how this broadening of scope would not affect all traders equally, because their unique sourcing patterns within Brazil expose them to different types of conversion (see figure).

Including other wooded lands would have particularly big implications for companies such as Bunge, which would see the amount of its exposure to deforestation and conversion that is covered by the regulation more than triple from 6,920 hectares (ha) to 24,600 ha, while Cargill would see that figure increase almost fivefold from 4,420 ha to 21,000 ha. Both are major exporters of soy to the EU and the companies most exposed to deforestation and conversion from this trade with the bloc.

Other companies with lower exposure to other wooded land conversion would still see dramatic changes, such as CHS’s tenfold increase from 732 ha to 7,360 ha. Meanwhile, Olam’s sourcing from the southern state of Rio Grande do Sul means it would be particularly affected if the Pampa grasslands were included, where 91% of its exposure to deforestation and conversion lies.

An opportunity for the EU to reduce its impacts on nature

If broadening the scope of the EU regulation led to reduced expansion of soy into Brazil’s non-forest ecosystems, it would be a major win for biodiversity. The Cerrado is home to more than 11,000 plant species, many of which are found nowhere else, and provides important habitat for animals including the giant anteater, giant armadillo and jaguar. The need to protect the Pampa grasslands from very high levels of recent soy expansion remains largely overlooked, despite it being a fragile ecosystem that is among the most species-rich grasslands on the planet.

Past experience from the Amazon Soy Moratorium – an agreement by around 20 major soy traders to stop sourcing soy from land that was deforested after July 2008 – shows how concerted effort from traders, combined with strong governance and deforestation monitoring, led to a drastic reduction in direct deforestation for soy in the Brazilian Amazon. However, because this policy was restricted to the Amazon, it is argued that about half of the avoided deforestation was pushed into other regions such as the Cerrado.

Extending the EU regulation to cover other ecosystems is critical to help to stop similar ‘leakage’ effects happening again.However, it is crucial that the EU applies a common cut-off date (the point in time after which production is considered to be linked to deforestation or conversion) to all types of conversion, to avoid incentivising rapid expansion into other vulnerable ecosystems while their potential inclusion is reviewed.

A chance for traders to manage compliance risk

For traders, increasing the scope of the EU regulation means that they would likely face greater scrutiny on a much larger portion of their sourcing, and have to supply farm-level information on their sourcing from more high-risk regions.

Traders are well-advised to ensure their sourcing is not connected to the conversion of anynative ecosystems, especially because many of them already have zero-deforestation commitments that include these ecosystems. While this seems complex, Trase data shows that their exposure to deforestation and land conversion is highly concentrated in a few places, highlighting priority regions to engage with producers and revealing where they might want to improve their supply chain traceability.

Additionally, traders should commit to not expand soy processing infrastructure in areas that are frontiers of deforestation and conversion. Instead, they should focus infrastructural expansion in regions with large areas of degraded and under-utilised pasturelands, which totalled more than 33 million hectares in 2021. This would send a signal to producers that would encourage soy expansion without promoting further conversion, helping pave the way for traders to comply with evolving demand-side regulation, their own zero-deforestation commitments and helping to secure Brazil’s globally important biodiversity.